Content Hub

Content Hub

Global crisis and technical advancements are revolutionizing the operational risk landscape

Gain practical, forward-looking insights and access in-depth analysis on the most compelling challenges facing the industry.

OpRisk Content Hub

Correlations in operational risk stress testing: use and abuse

Correlations between operational risk loss severity, frequency and economic factors have been used as a de facto tool to assess economic and regulatory capital since 1990. We demonstrate, using data from a single retail bank, that such correlations do not apply universally, and that projections of capital requirements are subject to wide error margins.

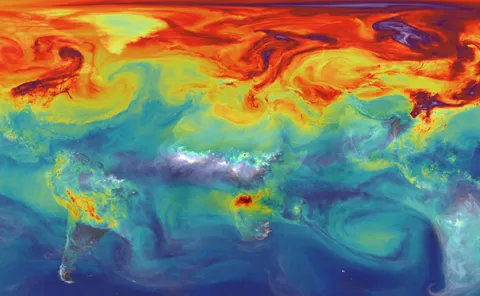

How climate change may impact operational risk

The Basel Committee on Banking Supervision has noted that there has been “very limited focus” on the impacts of climate change on operational risk. This paper seeks to address this lack of focus. It concludes that climate change may drive operational risk losses through complex interactions between three factors: changes in human and institutional behaviors, significant and rapid changes in economic metrics and direct physical impacts.

Machine learning for categorization of operational risk events using textual description

This paper provides an overview of how machine learning can help in categorizing textual descriptions of operational loss events into Basel II event types.

How does the pandemic change operational risk? Evidence from textual risk disclosures in financial reports

How the Covid-19 pandemic changed the operational risk profiles of the financial industry? This paper shows that the textual risk disclosures in financial reports contain abundant information on operational risk.

Getting op resilience right: breaking down silos and developing a cohesive data strategy

As banks further define their frameworks for operational resilience, firms are now grappling with developing a cohesive data strategy, correlating regulatory expectations and defining concrete outcomes. This Risk.net webinar covers how leading banks are moving beyond departmental silos to be more customer-centric and better understand the impact of disruption using data.

The future is now: how data science is revolutionising risk management and finance

Data science is playing an increasingly pivotal role across capital markets, potentially transforming decision-making across trading, risk, banking and investment.

Risk culture 2.0: redefining attitudes and behaviours in an era of change

The world is a very different place than it was prior to the Covid-19 pandemic. From changing work patterns and operational change to geopolitical tensions and rampant inflation, risk departments have never been under so much pressure.

Scenario construction: taking a standardized approach to benchmarking risk exposures (November 3rd, 2022)

A common obstacle faced by operational risk managers seeking to measure the threat posed by risks is the lack of data to help them assess the stakes. Nowhere is this more evident than for emerging risks and extreme events, for which data is not available or for which a given financial institution has simply not experienced losses. How do industry players propose to fill this gap and create an industry standard that could give a comprehensive picture?

Resilience Playbook

Without a doubt, 2020/2021 has been the most volatile and precarious year in recent history. For the first time, all organisations faced significant challenges to business continuity and felt the immediate impact of decentralisation. Our Resilience Playbook brings together the key insights and practical takeaways from the 2021 OpRisk Global event.