Sponsorship Opportunities

Align your brand and reach a global oprisk audience

About Operational Risk Global

The OpRisk Global Series attracts more than 650 senior decision-makers across operational, cyber, third-party, digital, technology and emerging risks, along with governance, financial crime and compliance.

This senior audience is seeking innovative insights and practical solutions to the industry’s most pressing challenges.

Audience breakdown

2022 ONLINE AUDIENCE

1000

Delegates

512

C-level / Global Head / Director

20

Hours of content

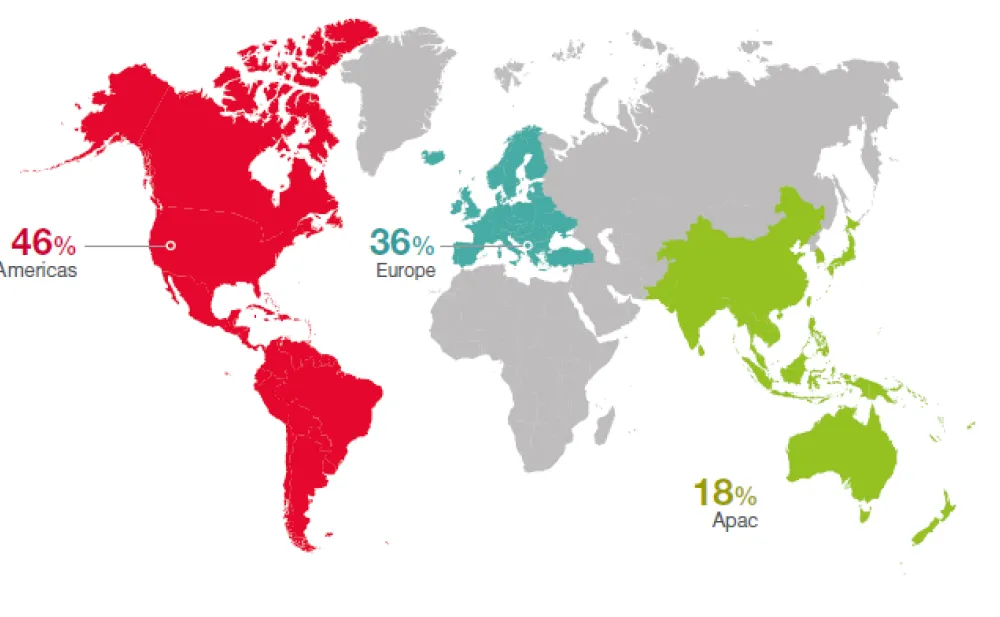

Operational Risk global reach

The vast Operational Risk database spreads across the USA, Latin America, Europe and APAC.

Americas - 46%

Europe - 36%

APAC - 18%

480000

contacts across the Risk.net database

14000

delegates attended a Risk.net event over the past year

40000

op risk professionals

28000

professionals subscribe to Risk.net newsletters

The event brings a collective view on how we can better manage operational risk, not just for the firm but for the financial industry as a whole.

Morgan Stanley

Extremely knowledgeable speakers, engaging and fielded any questions.

State Farm

A well-organized event with good networking opportunities.

SmartStream

Key topics

Operational resilience in a post-Covid world

Climate resilience

Emerging risks (Tech, ESG/ climate, Conduct)

Fraud/AML

TPRM

Conduct risk

Regulatory risk

Cyber risk

Advisory board members

Angela Johnson de Wet

Head of governance and compliance - cloud enabled business transformation

Lloyds Banking Group

Head of Governance and Compliance - Cloud Enabled Business Transformation

Ange is responsible for Governance and Compliance for Lloyd Banking Group’s Cloud Enabled Business Transformation Programme. Before her current role, Ange was Head of Cloud and Technology Change Risk.

Prior to working at Lloyds, Ange led transformation teams and programmes at Deutsche Bank including: Cloud Security, Risk and Compliance, Anti-Financial Crime Analytics, Data Quality People Change and Money Markets Finance, Risk and Regulatory Reporting.

Before joining Deutsche Bank, Ange worked as a Senior Manager at EY across Asia Pacific and EMEIA within the Financial Services Organisation focusing on Corporate Banking and Capital Markets transformation and business, technology and programme advisory. Ange started her career at IBM in Australia working as a developer, tester, designer and then business analyst and project manager.

Ange has an honours degree in Mechanical Engineering (Mechatronics / Robotics) and Computer Science from the University of Melbourne, Australia.

Bala Ayyar

Managing director - Regulatory, Office of the Group COO

Societe Generale

Since joining SG in 2009, he has held a range of positions. Currently, he is the Chief Data Officer, SG Americas, with responsibility for data management and governance within the Region. This function is responsible for implementing the requirements of BCBS 239, establishing sound data governance framework that meets Group needs and local supervisory expectations, and creating a solid platform for the data to be leveraged for strategic business decisions. Prior to that, he headed up the Project Management Office for the SG US Transformation project. SG roles before that included Deputy CFO of the Americas Region of their Corporate & Investment Bank and Head of Finance Offshoring in SG Bangalore.

Prior to joining SG, Bala was with the Canadian Imperial Bank of Commerce (CIBC) for fourteen years in a range of positions in Toronto and New York. As Senior Vice President of the Wholesale North America Finance, he headed up the controllership function for CIBC’s World Markets and Treasury & Risk Management Strategic Business Units within North America. With a global team across Toronto and New York, he was responsible for establishing a SOX-compliant industry-leading Finance control environment as well as supporting the efficient execution of business initiatives and managing the Finance related US regulatory relationships during a very demanding period. Prior to that, he also had stints as the business-line controller for the Bank's US origination businesses (Corporate Lending, Investment Banking, Merchant Banking, Structured Finance, and High Yield), as well as the 2/ic to the Chief Accountant, with responsibility for consolidated financial, management and regulatory reporting at the corporate level.

Born and brought up in Mumbai India, Bala has a degree in mathematics from the University of Mumbai and holds professional accounting qualifications from both India and the United States. He lives in Montclair, New Jersey is married with two children, and enjoys long-distance running.

HG

Chief control officer, wealth and personal banking

HSBC

Nedim Baruh

Head of operational risk measurement and analytics

JP Morgan

Nedim Baruh leads the Operational Risk Capital and Analytics function at J.P. Morgan Chase ("JPMC") and is responsible for the Operational Risk Capital and Stress Testing processes.

Most recently, Nedim has been leading JPMC's effort to enhance its Scenario Analysis program by developing factor based models to assess its material risks. This work will help JPMC bridge the gap between operational risk measurement and management.

Prior to joining JPMC, Nedim was part of the Algorithmics Operational Risk advisory function and led many client engagements in the operational risk space.

Nedim has a B.S. in Economics from the University of Pennsylvania.

Tanya Weisleder

Global head of conduct risk

Credit Suisse

Tanya joined Credit Suisse in January 2017 from Citi where she spent 16 years in various senior Business, Risk and Compliance roles; her most recent roles included the North America head of conduct risk and head of risk management practices for the US & Latin America International Private Banking Business.

At Credit Suisse Tanya is the global conduct risk head focused on the continual development of the Global Conduct Risk Strategy. She is a regular speaker on Conduct Risk at the biannual risk.net training industry training forum. Tanya obtained a Masters in International Affairs from Columbia University in New York, NY in May 2000 and a Bachelor of Arts in International Careers from the Lehigh University in Bethlehem, PA.

Yogesh Mudgal

Operational risk - global head enterprise tech/cyber risk; engineering & architecture, cloud, emerging tech

Citi

Previous attendees and sponsors

HSBC is a financial services organisation that serves more than 40 million customers, ranging from individual savers and investors to some of the world’s biggest companies and governments. Its network covers 64 countries and territories, and its expertise, capabilities, breadth and perspectives open up a world of opportunity for its customers. HSBC is listed on the London, Hong Kong, New York, Paris and Bermuda stock exchanges.

MetricStream is the global market leader for Integrated Governance, Risk, and Compliance (GRC) solutions. We provide the most comprehensive solutions based on a single platform that includes Operational Risk, Compliance, Audits, IT and Cybersecurity, Business Continuity and Third-Party Risk Management. Today, there are more business risks than ever. These risks include financial crises, globalization, cyber breaches, pandemics, and climate change. That’s why ESG (Environmental, Social, and Governance) concerns are increasingly becoming a priority at the top of every organization. These concerns require a greater emphasis on GRC solutions that can assist CEOs and board members in auditing, policy management, compliance management and risk management. To flourish in the digital economy, organizations must skillfully manage peripheral risks that can hinder business performance. In this new digital era, GRC becomes the prerequisite for building resilience, seizing new growth opportunities, and successfully navigating the future. MetricStream’s simple purpose-built platform, proven with over a million global users, is designed to serve integrated GRC use cases across industries and is powered by deep domain expertise, embedded content, rich context, integrated data and explainable AI. Since 2001, MetricStream has empowered organizations to intuitively harness front-line intelligence that enables all stakeholders to make real-time risk-aware business decisions.

At EY, we share a single focus — to build a better financial services industry, one that is stronger, fairer and more sustainable.

Our strength lies in the proven power of our people and technology, and the possibilities that arise when they converge to reframe the future.

Our professionals are dedicated to the industry, and live and breathe financial services. This deep sector knowledge combined with a holistic point of view, delivers true value from strategy through to implementation. Whether your business challenge is specific, complex, small or large, we can be trusted to deliver solutions that work for today and tomorrow.

By using technology as a tool, to transform what a business can be, and people can do, we are building long-term value for our financial services clients. It is how we play our part in building a better working world.

Linklaters is a leading global law firm, supporting and investing in the future of our clients wherever they do business. We combine legal expertise with a collaborative and innovative approach to help clients navigate constantly evolving markets and regulatory environments, pursuing opportunities and managing risk worldwide.

Our 5,200 people, of which almost half are lawyers, are located across 30 offices in 20 countries. In order to offer our clients the highest quality advice, our lawyers across three divisions; Corporate, Dispute Resolution and Finance, specialise in industry sectors as well as practice areas.

The usage and Risks from Spreadsheets and other End User Computing (EUC) tools such as Python/R/SQL/SAS/RPT files and Access databases continues to increase, in response to fast changing market conditions, economic uncertainty and regulatory mandates.

CIMCON’s EUC Insight is an intelligent, automated and unique software platform that reduces these risks across the entire EUC Life Cycle. Its Discovery, Inventory, Monitoring and Disposition modules identify new EUCs and assess risk, inventory them, monitor for high risk changes and dispose as needed. A single user interface integrates all modules and file types. XLAudit is a visual, easy to use Excel plugin that performs quick validation, logic and error checks on spreadsheets and documents the results.

Whether your EUCs are already on the Cloud or will be, CIMCON tools and services can help. We support all major Cloud repositories and can help fix links that break when moving to Cloud.

We can also migrate your legacy Access databases to a web application on cloud. CIMCON has a wide range of consulting, technology and reseller partners around the globe. With 25 years of experience, 500 customers in 30 countries, and a #1 ranking by Gartner, CIMCON is the only company you will ever need to manage all of your EUC needs.

Milliman is among the world’s largest providers of actuarial, risk management, and related technology and data solutions. With over 60 offices around the globe, our consulting and advanced analytics capabilities encompass the fields of healthcare, property and casualty insurance, life insurance, financial services, and employee benefits. Our breadth of expertise and data solutions provide insight into the interplay between physical, health, and economic risks, as well as the ability to communicate those risks and inform key decisions for governments, communities, and businesses around the world.

BNY Mellon is a global investments company dedicated to helping its clients manage and service their financial assets throughout the investment lifecycle. Providing financial services for institutions, corporations or individual investors, BNY Mellon delivers informed investment and wealth management and investment services in 35 countries.

Interos protects customers’ brand and operations from risk in their extended supply chains and business relationships. The first AI-powered platform for eliminating multi-party, multi-factor risk from 3rd, 4th to nth tier parties, Interos automates discovery, detection, and response to financial, operations, governance, geographic, and cyber risk. Designed by experts and leveraging the company’s 15 years of experience in managing the world’s most complicated supply chains, Interos provides real-time risk management for the largest commercial brands in manufacturing, financial services, and aerospace and defense.

BNP Paribas is a leading bank in Europe with an international reach. It has a presence in 74 countries, with more than 192,000 employees, including more than 146,000 in Europe. The Group has key positions in its three main activities: Domestic Markets and International Financial Services and Corporate & Institutional Banking, which serves two client franchises: corporate clients and institutional investors. The Group helps all its clients to realise their projects through solutions spanning financing, investment, savings and protection insurance.

Fully integrated in the BNP Paribas Group, BNP Paribas Corporate and Institutional Banking (CIB) is a leading provider of solutions to two client franchises: corporates and institutionals, and operates across EMEA, APAC and the Americas. The bank is a global leader in Debt Capital Markets and Derivatives. It is a top European house in Equity Capital Markets and it has leading franchises in Specialised Financing. In Securities Services, it is a top five house worldwide.

OneTrust Vendorpedia™ is the largest and most widely-used technology platform to operationalize third-party risk. The offering enables both enterprises and their vendors with technology solutions that include: the Third-Party Risk Exchange, a community of shared (and pre-completed) vendor risk assessments with 70,000+ participating vendors; Questionnaire Response Automation, a tool that helps organizations answer incoming security questionnaires; and Third-Party Risk Management software, a platform to streamline the entire vendor lifecycle, from onboarding to offboarding. More than 7,500 customers of all sizes use OneTrust, which is powered by 75 awarded patents, to offer the most depth and breadth of any third-party risk, security, and privacy solution in the market. OneTrust Vendorpedia offers purpose-built software designed to help organizations manage vendor relationships with confidence, including and integrates seamlessly with the entire OneTrust platform, including – OneTrust Privacy, OneTrust GRC, OneTrust DataGuidance™, and OneTrust PreferenceChoice™.

Fusion Risk Management is a leading industry provider of cloud-based software solutions for operational resilience, encompassing risk management, third-party risk management, IT and security risk, business continuity and disaster recovery, and crisis and incident management. Its products and services take organisations beyond legacy solutions and empower them to make data-driven decisions with a comprehensive and flexible approach through one system. Fusion and its team of experts are dedicated to helping companies achieve greater operational resilience and mitigate risks within their businesses.

Phyton Consulting focuses on the most complex initiatives facing our clients and strives to be the best subject matter-led, execution-focused group on the street. Our services are conceived to address your industry-specific business and data challenges with the right blend of tactical and strategic execution.

Bottomline helps make complex business payments simple, smart and secure. Banks rely on Bottomline for domestic and international payments, state-of-the-art fraud detection, insider fraud protection, behavioural analytics, consolidated case management and regulatory compliance solutions. Banks worldwide benefit from Bottomline cyber fraud and risk solutions. Headquartered in Portsmouth, New Hampshire, Bottomline delights customers through offices in the US, Europe and Asia-Pacific. For more information visit www.bottomline.com.

Archer is a leading provider of integrated risk management solutions that enable customers to improve strategic decision-making and operational resilience with a modern technology platform that supports qualitative and quantitative analysis driven by business and IT impacts.

As pioneers in governance, risk and compliance software, Archer remains solely dedicated to helping customers manage risk and compliance domains, from traditional operational risk to emerging issues such as environmental, social and governance. With more than 20 years in the risk management industry, Archer's customer base represents one of the largest pure risk management communities globally, with over 1,600 deployments, including more than 90 of the Fortune 100.

Join the OpRisk series

November 03, 2022

June 2023, London

Contact us today!

If you would like to discuss our 2022 sponsorship opportunities and vendor packages, please contact us today:

Sponsorship enquiries

Antony Chambers

Publisher, Risk.net/FX Markets/WatersTechnology